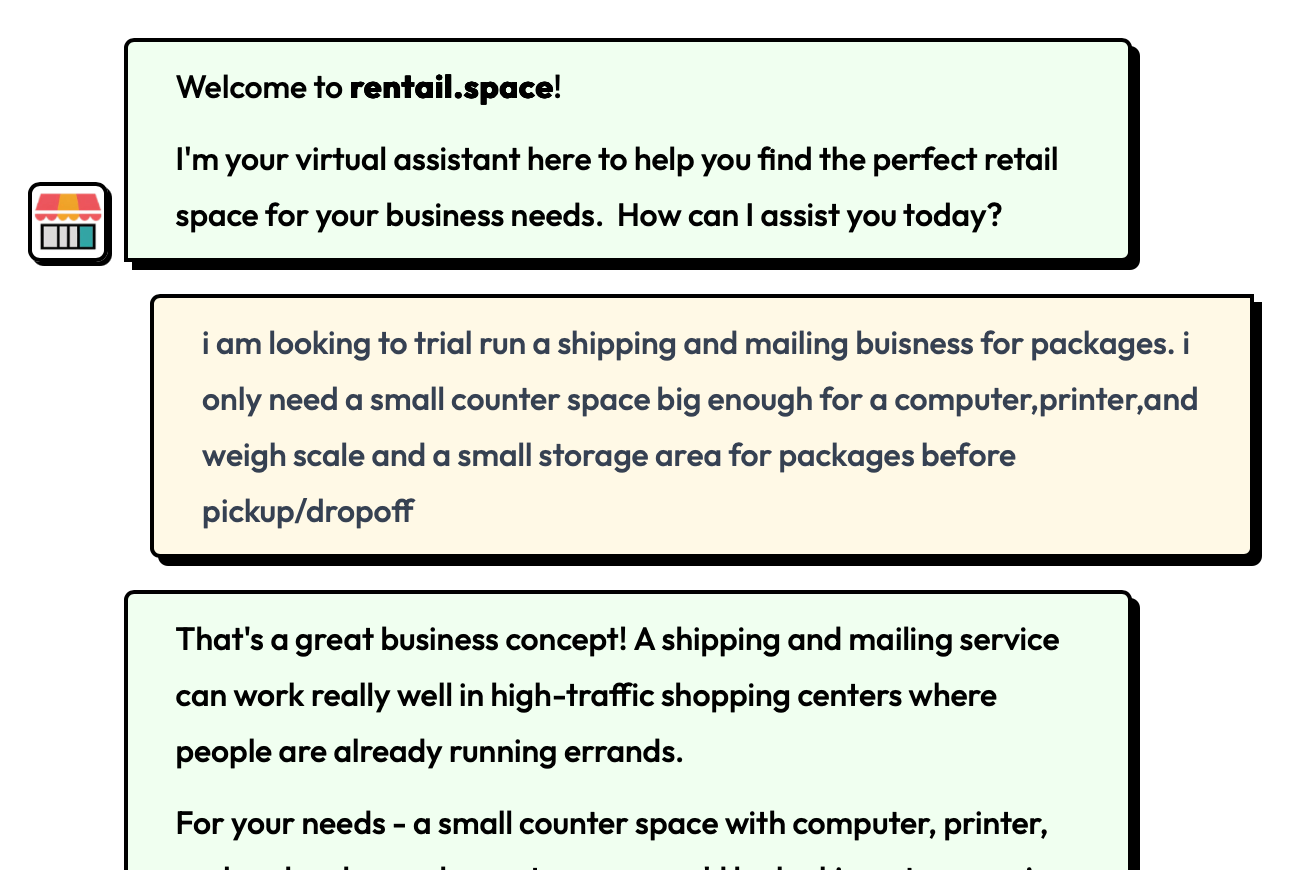

Find Your Next Mall Spacein Under 2 Minutes

147 micro-merchants found their mall locations using our site. No broker meetings. No endless calls. Just instant matches with spaces ready for your products.

Find My MatchWhy Choose rentail.space?

We help you find short-term retail spaces in shopping centers near you, at reasonable prices, with the foot traffic to make your business succeed.

Find the Perfect Space

AI-powered matching finds retail spaces with the foot traffic and location your business needs to thrive.

24/7 Availability

Browse and book retail spaces anytime, anywhere. No waiting for business hours or property managers.

Seamless Booking

Sign up once to access all shopping centers in your area. We handle contracts and payment processing.

Flexible Pricing

Daily, weekly, or monthly rates that fit your budget

No Long-term Commitment

Test markets without multi-year leases

Dedicated Support

Expert help throughout your rental journey

What is Specialty Leasing?

Specialty leasing refers to short-term retail space in malls, shopping centers, and other retail centers. It includes flexible options like RMUs (Retail Merchandising Units), retail carts, booth rentals, kiosk spaces, and pop-up shops. These options allow businesses to test new concepts while adding variety to the consumer experience—all without long-term commitments.

The Perfectionist's Paradox: Why Waiting Kills Competitive Advantage

The perfectionist's trap looks responsible. It feels like quality control. In reality, it's a strategic failure disguised as standards.

The Type-A Trap: Why Speed Without Context Costs You Talent

Type-A leaders have a superpower: decisiveness. They see patterns fast, synthesize information quickly, and drive toward conclusions while others are still processing. This trait builds companies.

The Hermit Leader Problem: Why Hunkering Down Kills Momentum

Early-stage founders face relentless uncertainty. Missed sales target. Key employee quits. Product launch flops. The instinct is to hunker down—withdraw, overthink, wait for clarity before moving forward. It feels protective. It's actually poisonous.

The Comparison Trap: Why Focus Beats Imitation

Every founder hits this wall. You're building something real, gaining traction, then you see a competitor drop a massive campaign. Suddenly your wins feel small. Your team's execution looks inadequate. The mental spiral begins.

Viral posts don't need million views

You don't need influencer reach. You need customers thinking about your business.

Bridging the Gap: Connecting Gen Z Merchants with Shopping Centers

Our platform connects Gen Z entrepreneurs with shopping centers seeking fresh energy and innovative concepts. By simplifying access to short-term retail spaces, we empower new businesses and help centers attract diverse audiences. This marketplace fosters collaboration, community, and a dynamic future for retail.